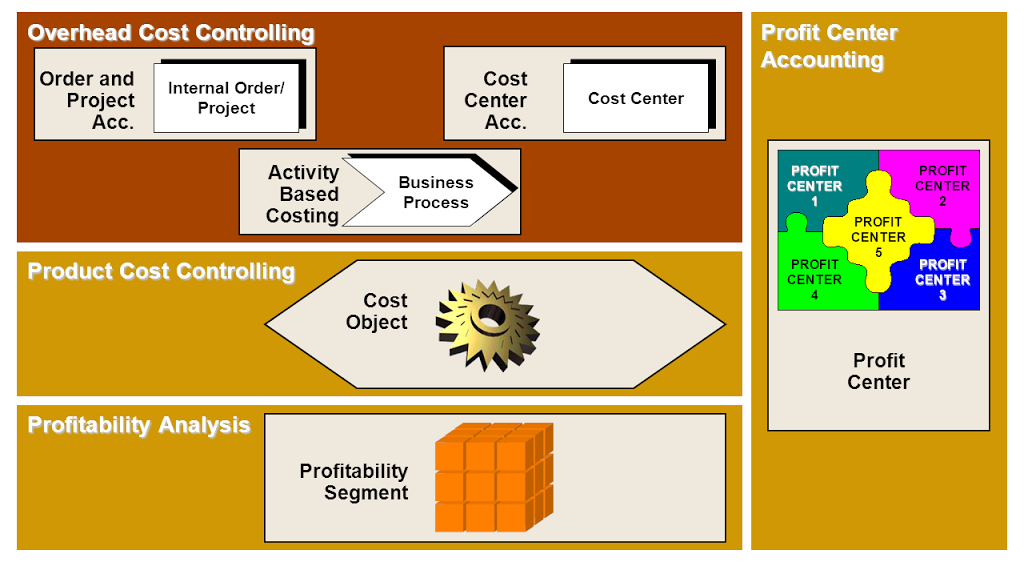

• Controlling includes all functions required to internal managerial accounting and covers different areas for control.

• CO-OM Overhead Cost Controlling: Overhead costs are costs that are not directly related to a product, and thus cannot be assigned directly to the cost of goods. They are divided into direct and indirect costs. The purpose of CO-OM is planning, allocating, controlling and monitoring overhead costs.

• CO-PC Product Costing Controlling:Product costing is a tool for planning costs and establishing prices for materials. It is used to calculate the costs of goods sold for each product unit.

• CO-PA Profitability Analysis: Lets you evaluate segments of your business operations, which can be defined according to products, customers, orders and any combination of these or other organizational structures (such as sales organizations or business areas). The goal is to determine the contributions of those segments to your company’s profits (margin reporting).

• CO/EC*-PCA Profit Center Accounting:Provides profitability-oriented performance information for internal organizational units (profit center) and assign respon

sibility to their performance. It can be used to generate financial statements for the corresponding organizational units. (* SAP classifies PCA into the Enterprise Controlling (EC) component.)