Company: Smallest organizational unit for which individual financial statements can be drawn up according to the relevant commercial law. A company can consist of one or more company codes.

A company is generally used in the legal consolidation module to roll up financial statements of several Company-Codes. A company can consist of one or more Company-Codes. It is important to make the distinction that a Company is NOT the same as a Company-Code.

Company code links – What is a company code? Company code Configuration

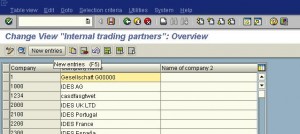

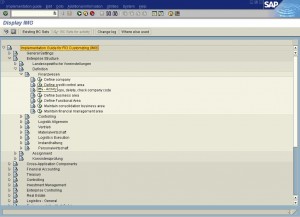

Menu Path:

SAP Reference IMG -> Enterprise Structure -> Definition -> Financial Accounting -> Define Company