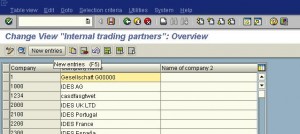

Company code is the central organizational unit used for financial accounting purposes. This is the most important organizational unit in SAP (without which FI cannot be implemented). Every legal entity is created as a company code in SAP. This is the central organizational unit to which all other organizational units of other modules will be assigned.

Examples of dependency to other modules

- Plants of MM Module assigned to company code

- Sales organization of SD is assigned to company code

- Personnel area of HR is assigned to company code