Fiscal year variants in SAP

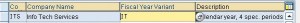

A financial year is termed as a fiscal year. A fiscal year may or may not be the calendar year depending on the country. Fiscal year variants defined in SAP are:

- V3 – April to March

- K4 – January to December

- V6 – July to June

- V9 – October to September

Fiscal year Variant – OB29

FICO Configuration Series – Part 3

Fiscal year variant

The fiscal year variant determines the posting periods to be used by the client’s company. SAP allows a maximum of 16 posting periods each fiscal year – normally 12 regular posting periods and 4 special posting periods are used. The special posting periods are used for posting audit or tax adjustments to a closed fiscal year.

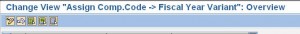

Financial Accounting >> Financial Accounting Global settings >> Fiscal Year >> maintain Fiscal year variant (maintain shortened fiscal year)

Transaction Code: OB29

You can copy existing values or create ones from scratch.

Financial Year Variant: Enter the two-digit alphanumeric identifier of your fiscal year variant. Avoid using K or V as the first character as SAP delivered financial year variants use them.

Calendar Year: Set this indicator if the fiscal year is also the calendar year.

Year-Dependent: Set indicator if fiscal year is changing from year to year.

Number of Posting Periods: Enter the Number of normal posting periods (maximum is 12) [correction based on comment – can be more than 12, thanks to Singh]

Number of Special Periods: Enter the Number of special posting periods

Annual Displacement: Enter values as -1, 0 or +1. For years which have the fiscal year same as the calendar year, always use 0. For -1 and +1 are used to offset whenever calendar year is different from the fiscal year.

Assignment: Saks Apparel operates on an April-March calendar month fiscal year. (So, copy any existing year variant that uses April-March year). Create a Financial year variant SA. We also setup 12 regular posting periods and 4 special posting periods.

Some more details on fiscal year variants configuration

POSTING PERIODS

IMG: FI.A/cing> F.A.Global settings>Document>Posting Periods> Open and close posting periods.

1) Several Company codes can use same posting period variant.

2) The SAP system automatically determines the posting period and fiscal year based on the posting date entered. (Only special period needs to be manually changed)

3) The posting period variant is assigned to the company code.

4) Posting periods are defined in the fiscal year variant, Closing/opening posting period are carried out in posting period variant.

5) The posting period variant must contain at least the account type “+”.

6) During year closing, two period intervals (Normal and special periods) must be open at the same time.

7) In the document header, the periods assigned to the account type “+” are checked with posting date, whether posting period is open for that date or closed. At the line item level, the system checks the account type of the posting key to ensure that the period is open for the assigned account type.

Fiscal Year

1) Fiscal year types.

Year Specific/Year dependent Fiscal year.

Year independent Fiscal year

1) Calendar Year.

2) Non Calendar year.

2) Fiscal Year Variant only defines the number of periods and their start and finish dates.

3) SAP determines the posting period from the posting date.

4) Posting periods can be defined up to 12 and Special periods up to 4.

5) Posting periods can be up to 999 and Special periods can be up to 99 – Posting periods more than 16 (Including special periods) can only be used for special purpose ledger applications.

6) A shortened fiscal year is a fiscal year having less than twelve months. The definition of a shortened fiscal year is always year-dependent, since it represents a year-related exception.

7) For year specific fiscal year – Posting periods for each fiscal year needs to be defined in configuration with reference to calendar years.

IMG: Financial A/c-ing -> Financial A/c-ing Global setting -> Fiscal Year -> Maintain Fiscal year variant.