Material valuation is one of the “must-know” topics for all SAP Material Management (MM) learners, especially for MM consultant, FI consultant, and FI & MM administrator in a company. In a company, the material valuation procedure must be determined together with accounting department. It determines, among other things, how a material transaction recorded in accounting journal.

The first thing that we should know in material valuation is the Valuation Area. It is the organizational level at which material is valuated. In SAP R/3 system, there are two possible organizational level at which material is valuated:

1. Plant.

When stock is valuated at plant level, we can evaluate a material in different plants at different prices. Valuation must be at this level in the following cases:

· If we want to use the application component Production Planning (PP) or Costing

· If our system is a SAP Retail system

2. Company Code.

When stock is valuated at company code level, the valuation price of a material is the same in all of a company’s plants (that is, in a company code).

SAP recommends that we set material valuation at Plant level.

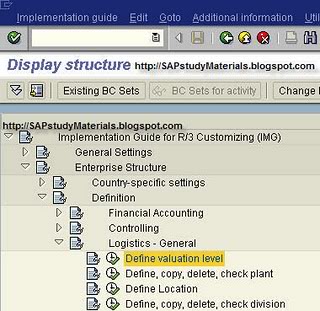

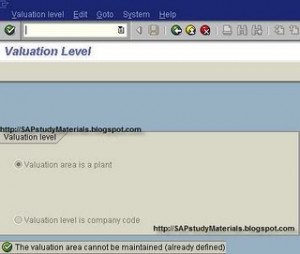

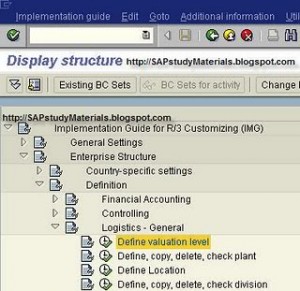

We can define the valuation level in configuration process with T-Code SPRO and will be valid for whole client. The configuration process can be seen at these screen shots:

If we’ve never defined this before, the “Valuation Level” screen will be editable, but in this example it is not editable because it has been defined before. Defining the valuation level in Configuring is a fundamental setting, and is very difficult to reverse.

The transactions in Inventory Management that can affect the valuation price of material in accounting record (depending on the type of price control) are:

· Goods Receipts.

· Goods Issues.

· Transfer Postings (for example, a stock transfer between two plants or a transfer posting from one material to another).

· Postings in Invoice Verification.

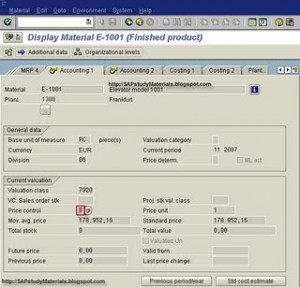

We must create the accounting data for each valuation area for all valuated materials so the above transactions can be carried out for those materials. In the accounting view of material master data, we can get an overview of the present valuation.

Valuation of goods receipts depends on the price control procedure we set in the material master record. In the R/3 System, material valuation can be carried out according to the moving average price procedure (V price) or the standard price procedure (S price).

In the standard price procedure (price control “S”), the system carries out all stock postings at a price defined in the material master. Variances are posted to price difference accounts.

In the moving average price procedure (price control “V”), the system valuates goods receipts with the purchase order price and goods issues with the current moving average price. The system automatically calculates the latter upon every goods movement by dividing the total value by the total stock quantity. Differences between the purchase order price and the invoice are posted directly to the relevant stock account if there is sufficient stock coverage.

Characteristic of Price Control “S”:

· All stock postings are made at a standard price.

· The system posts all differences from the standard price to an account “Expense/Revenue from price difference”.

· Exact values are available for cost accounting / controlling purposes (All goods issues, such as issues to a production order, are evaluated at the same standard price. This allows better analysis of the costs of production orders).

· In the accounting view, we can display differences between the delivered price and the standard price.

· We can change material prices if required (generally at the end of period). This causes the system to revaluate the total stock for a valuation area.

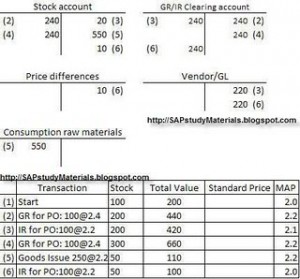

Posting at Standard Price.

A receipt posted to a stock account is generally posted at the standard price. Differences between the order price and the standard price are posted to an “Expenses/revenue from price differences” account (2).

Differences between the invoice price and the order price are posted to an “Expenses/revenue from price differences” account (3).

The moving average price is also recorded in the material master when the material is valuated at a standard price. It indicates the extent to which the standard price differs from the delivered price.

Characteristic of Price Control “V”.

· Receipts are evaluated at their actual price (as per purchase order, invoices,…)

· The system modifies the price in the material in the material master according to the delivered price.

· Issues are generally valuated at the current material price.

· The data used for cost accounting / controlling purposes therefore contains price fluctuations.

· Only in exceptional circumstances does the system post at a difference to the “Expenses/Revenues from price differences” account (The system makes a posting to an “Expenses/revenue from price differences” account for a material valuated at a moving average price only in the case of a debit or credit when the stock coverage in the company code is smaller than the quantity to be debited or credited, e.g.: When we reverse an invoice, the account movements made when the invoice was posted cannot always simply be reversed. For example, if there was sufficient stock coverage when we posted an invoice with a price variance for a material with moving average price, but when we reverse the invoice, there is insufficient stock coverage, the R/3 System posts the price difference in the credit memo to a price difference account, although the price variance was debited to the stock account when we posted the invoice)

· We can change material prices if required (generally at the end of period). This causes the system to revaluate the total stock for a valuation area.

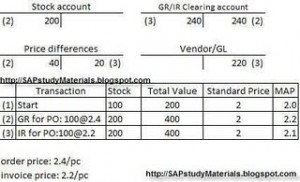

Postings at Moving Average Price.

Receipts to the stock account are posted with the value Quantity x Order price. The moving average price is recalculated after every transaction and is therefore adjusted in line with delivered prices (2)/(4).

Differences between the order price and the invoice price are debited to the stock account, as the invoiced quantity is in stock (3).

The difference between the order price and the invoice price is only posted for the 50 pieces in stock. For the remaining 50 pieces that are not in stock, the difference between the order price and the invoice price is posted to an “Expenses/revenue from price differences” account (6).