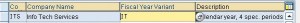

Fiscal year variants in SAP

A financial year is termed as a fiscal year. A fiscal year may or may not be the calendar year depending on the country. Fiscal year variants defined in SAP are:

- V3 – April to March

- K4 – January to December

- V6 – July to June

- V9 – October to September

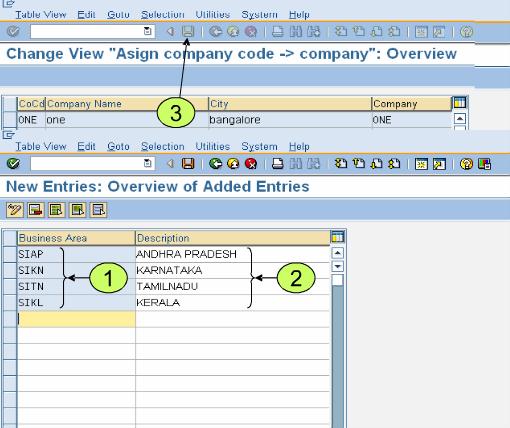

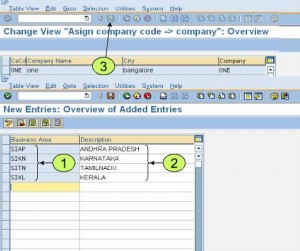

Business Area – OX03

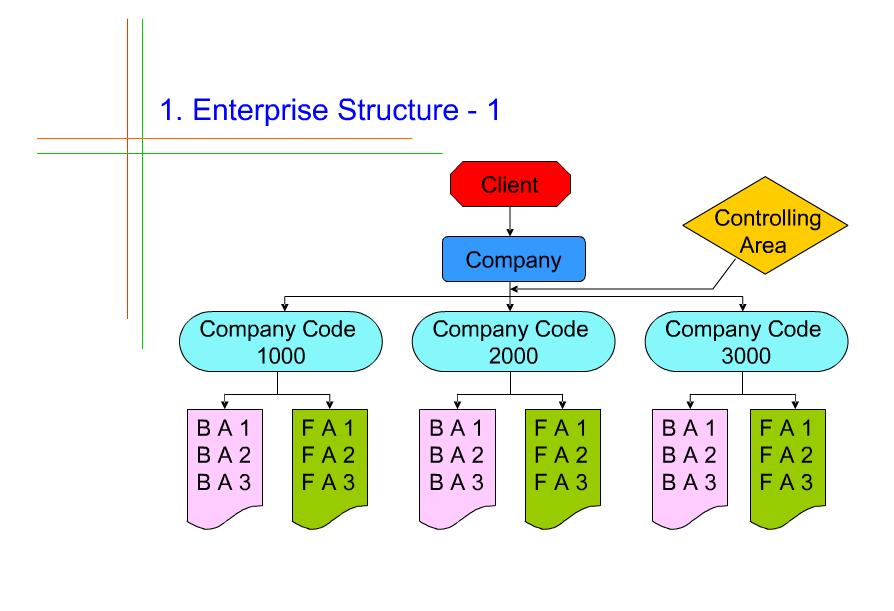

Define Enterprise Structure – Steps

- Define companies (define a company)

- Define Company codes (What is a company code?, Link1Link2, Define company code Global parameters)

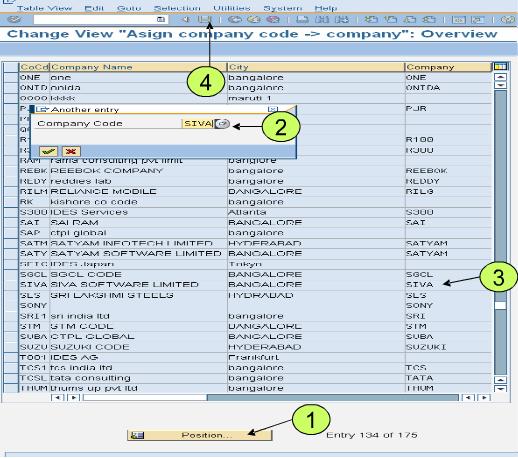

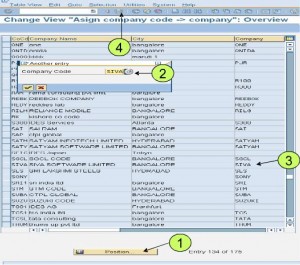

- Assign company codes to companies (Assign company codes to companies)

- Define business area

- Define functional area

- Define credit controlling area

- Assign business area, functional area, credit controlling area to company codes

Company and Company Code configuration

Create Company Code – OX02

Company code is the central organizational unit used for financial accounting purposes. This is the most important organizational unit in SAP (without which FI cannot be implemented). Every legal entity is created as a company code in SAP. This is the central organizational unit to which all other organizational units of other modules will be assigned.

Examples of dependency to other modules

- Plants of MM Module assigned to company code

- Sales organization of SD is assigned to company code

- Personnel area of HR is assigned to company code

Document Splitting

- New G/L in the SAP ERP system offers a powerful feature known as document splitting

- With document splitting, accounting line items are split according to specific characteristics – for example – Profit Center, Segment

- This way, you can create financial statements for entities such as Segments and meet legal requirements- For example, International Accounting Standards (IAS) requirements for segment reporting

Difference between FS10N and FBL3N

FBL3N – Display Change Line Items (gives the open item list)

FS10N – Display Acct Balances (gives the balance of transaction figure)

To say it very plain – Transaction FS10N displays balances, this balance could include many different asset numbers, drill down required for individual asset numbers. FBL3N displays detail, drill down not required.

In case you find that balances in the 2 transactions dont match:

1. Line item display was switched on after there had already been postings to the account (Check your master record for changes in FSS4 and see if the line item display was changed at any point. )

2. Archiving has been done (archiving line items but obviously keeping the account balance correct). It can be very time consuming, but you can always use SE16 on table BSEG (with your company code and account number as selection fields) to check the actual line items. Line item display uses one of the index tables (BSIS) and there can be differences between that and the actual document database, which SE16 will show you.

3. Check search criteria of FBL3N

4. Check the G/L account whether it is enabled to Line Item Display

5. Run the programm SAPF190 to check the gap

6. Check for your user role, if you have the complete authorization objects for T Codes FS10N and FBL3N. Please take the help of your Basis Consultant for that.

7. Execute the report TFC_COMPARE_V2 from SE38 and also see the program documentation (blue information button) on the selection screen of the report.

8. Run transaction SE38 and execute program RFSEPA01

GL Account Balance Display – FS10N

FS10N – is the the transaction code used for GL Account Balance Display.

Difference in Last year Closing balance and Current year Opening Balance

- This will be corrected after running carry forward programme FAGLGVTR (for ECC 6.0)

- Rerun the f.16 in test mode, this might generate the posting which would fix the disbalance

Note 402917 – If the opening balance does not correspond to the closing balance of the previous year on an account even after a repeated balance carryforward, you must always check whether you are dealing with a retained earnings account. If so, then you should check for inconsistencies in your system. And then you can activate the parameter for individualbalances retained earnings account during the start process of the balance carryforward program SAPFGVTR. You then receive a list of all P+L accounts with single values, which are balanced for the value of the retained earnings account. This means that you can reproduce and check the balance on the retained earnings account.

Asset number not displaying in report

SE16 for table BSEG will display asset number with the account balance.

Special fields on FS10N:

FS10N > Settings>Special Fields

This would promt a warning message stating that this would change a cross client table.

For example, if you make a change at client 800, it will change the setting on other table ( client 000 up to client 999). So, always discuss with ABAP folks before these configurations are changed.